What did you learn about money from TV?

And can you play the Knots Landing theme on the recorder?

Hi and welcome to The Ladybird Purse, my weekly newsletter about women and money. I’m not a financial advisor and am not qualified to give financial advice.

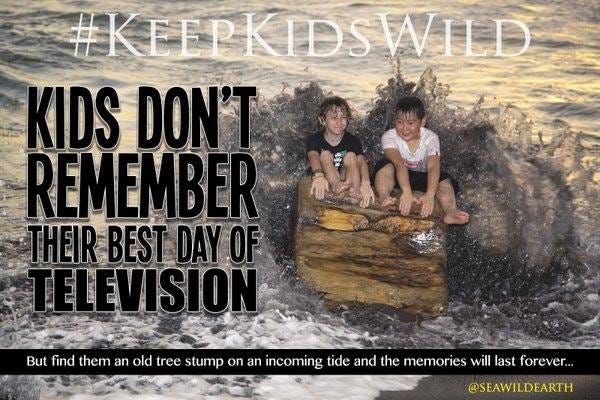

A few years ago, I saw this meme and it wound me right up

Aside from the health and safety nightmare of the fake photo, I absolutely remember my best days of television and they were all in the eighties.

When I started thinking about eighties TV in relation to money, I realised the shows fell into two camps.

The first, British TV where everyone was unemployed, poor, struggling. Liverpool soap opera Brookside (the 1985 siege storyline was one of my most thrilling viewing experiences); the 1986 sitcom Bread, about a working class Liverpool family trying to make money, not always legally.

I didn’t watch 1982’s Boys from the Blackstuff - I was only 11 in 1982 - but I remember people talking about it and “Gizza job”1, the catchphrase of Yosser Hughes, the unemployed main character, was unavoidable. The British Film Institute describes the series as “a warm, humorous but ultimately tragic look at the way economics affect ordinary people.”

But we didn’t only watch shows set in Liverpool! My other early obsessions were the glamorous US soaps: Dallas, Knots Landing2, Dynasty, The Colbys, Falcon Crest, which I was absolutely too young for. (I remember my uncle telling my mum she shouldn’t let us watch them. But we were watching them with her!)

Escapist? Yes. Aspirational? Sometimes. In almost unbelievable contrast to the British TV shows I watched? Absolutely.

In her interview a couple of weeks ago, Jenny said:

If I think about the 80s media vision of rich people, I think of Dallas and Dynasty – and that to me read as a very undesirable lifestyle and way to be. Or, back in Britain: Howards Way (I’m making myself laugh thinking about Howards Way). Rich women were always bitches!

I don’t think I thought it was an undesirable lifestyle? Not all of it. (I probably wasn’t on board with, say, any murdering.) It must have surely appealed more than the desperate and sometimes tragic scramble for cash in the British TV shows I loved.

Jenny’s right about the bitches though. And her comment also reminded me of my best friend around the same time. Her mum owned her own business. The only mum of my friends to do so, I’m pretty sure. Most of my friends’ mums (and my own mum) were housewives or had part-time jobs to fit around the kids (my mum was a dinner lady at this time). But this friend’s mum owned a hair and beauty salon. And it was called Rich Bitch & Delilah3.

Brookside did have one aspirational - at least to me - character. Heather Havisham (played by Amanda Burton) and her husband were the show’s “yuppie” characters. All I remembered was that she had a “good” job, but when I just googled, I learned she was “ambitious and studious, determined to be a successful accountant.” Not exactly Dynasty. Presumably because there wasn’t much dramatic mileage in accountancy, Heather’s storylines mostly focussed on her disastrous love life. To be fair, teen me mostly focussed on her hair.

I do wonder how all of this - at both an impressionable age and also a terrible time financially for my family - influenced how I think about money. There’s never enough money. If you have money, you’re a rich bitch. And if you’re ambitious you’ll never find love, no matter how great your hair is.

What was your best day of TV? What did you watch growing up that influenced how you think about money?

No post from me next week. I’m trying to take a few days off for my birthday. Back the Monday after and there’s still a Thursday post for paid subscribers - this week it’s a follow up on this interview with Hayley Webster.

If you’re not a paid subscriber already, I’d love it if you’d consider upgrading. Paid subscribers receive a second weekly post along with access to three (3) years of archives.

If you would like a paid sub, but can’t swing it right now, email me and I’ll sort it.

An anonymous interview with a 54yo

What is your relationship with money currently?

Presently and for the last ten years or so, my relationship with money has been one of saving as much as I can, whenever I can, because I rent and I want to buy. I know my age is against me but I have a partner now and he wants to buy too, so we hope once we have the deposit that we'll be able to get a relatively decent mortgage, fingers crossed (though I do worry about my age).

I'm a self-employed freelancer so always have a pot of savings that would serve to keep the wolf from the door if I ever couldn't work, yet also I'm trying to build that up into a deposit for a mortgage as well.

What’s your earliest money memory?

I remember stealing coins from my mum's purse! I feel terrible about that now!

Did you have a job as a teenager? If so, what did you do? Do you remember what and how you got paid?

I worked in a bar from age 18 and also I was a cook in a pub too. I was paid cash in hand. I didn't even know about taxes then and certainly never paid any. But my earnings were so low, maybe I didn't even need to, who knows!

Did you feel pressure to ‘have it all’ - family, career, etc. If so, do you still?

No, I didn't really, to be honest. I stopped working before I was pregnant to focus on my writing career, using some money from a legacy. And then when I had my child I worked from home a bit and was a stay-at-home mother for some years.

I never felt that pressure because I was determined to become a published author and that - plus raising my daughter - were my priorities.

What did you learn about women and money from TV or film? Or even music?

There was always a general feeling growing up in the 1970s that men were good with money and bank managers were always men and so were accountants. Yet the truth was that my mother was expert at handling money and ensuring we all had what we needed.

It dawned on me later that I was never taught a damned thing about money. I only learnt about savings, pensions and investments when I was in my mid-40s and by then it almost felt too late. It wasn't too late, of course, and I did set up some savings and so forth, but I wish I'd known about it 25 years earlier.

What advice would you give your younger self about money?

Start a pension at 18! That's what I've done for my child. I wish someone had told me this and I'm pretty annoyed that nobody did teach me about money. I'm certainly rectifying that now with my own child.

What have you learned from the generations on either side of Gen X (Boomers and Millennials) about money?

As I say, I was taught virtually nothing by my parents about money, which I do feel now is remiss. I look back at how cheap mortgages were back then and I could cry.

I wish I'd kept the house I bought in the 90s with an ex but we sold it when we split up. Again, thinking about how much that house would be worth now makes we weep with frustration, especially when I think about how I've been paying my landlady's pension with my rental payments for the last 9 years since I became a single parent.

What’s the best thing you’ve ever spent money on?

I bought a brand new car 20 years ago that lasted 17 years with very little work needing doing on it. Best investment I ever made.

Do you have a pension? If not, do you have a plan?

I do have a small teacher's pension which I can and will access next year. It'll be just enough to pay most of the rent (or perhaps a bit less than half the mortgage when we ever manage to buy a house), so it'll be very useful.

Other than that, I set up a private pension a couple of years ago and pay as much into it as I can afford. I don't intend to touch it until I'm desperate and at least well into my 70s.

What would you do with £10,000?

Straight into the mortgage deposit fund!

What little treat would you buy with a tenner?

Cake, every time.

If you were me, what would you want to ask women about money?

Do you teach your kids (or other kids you care about) about money?!

It's dreadful how little parents and the education system teaches its young'uns about how important money is, how to save, invest and create a pension fund for the future. It's a crucial life skill and mostly left completely to chance. I wish I knew then what I know now. And then I wouldn't be so skint and my money situation so precarious!

Read more Gen X posts

If you’d prefer not to subscribe, but would still like to support me/this newsletter, you can make a one-off payment:

THE LATEST POST ON MY OTHER SUBSTACK, HAPPY ENDINGS…

…is about a practically perfect weekend.

For non-Scousers, “Gizza job” means “give us a job” and “us” means “me.”

I taught myself to play the theme tune on the recorder. Yes, I’ve always been cool.

Second part of name changed since nothing comes up when I google it and I don’t want this post to come up if anyone else googles it!

Interesting to reflect on! I’ve written a massive piece on finances for the second book I’m in the process of publishing on making peace with migraine. (Super hard and challenging to write - I had to give a lot of space to it and can see why there are so many topics we don’t talk about - especially in the field of chronic illness - but for the benefit of our health, we need to.)

I’ve been guided by my ancestors to send back the gift, “the truth of independence”. A piece I’m including at the end of the section on finances.

All I can say is, it’s going to send a very different message to what we’ve been taught in schools, on tv and by our parents!!

Knots landing!! Oh the memories, Valeen! Gary and of course Abby!