Money is fake, Harry Styles is forever

+ $100 bills, Benetton sweaters, and me forgetting the US is a different country

Hi and welcome to The Ladybird Purse, my weekly newsletter about women and money. I’m not a financial advisor and am in no way qualified to give financial advice.

In one of my first newsletters, I talked about how spending a chunk of money travelling to see Harry Styles on tour in America really helped me relax about money. (Yes, the me writing this weekly newsletter is relaxed. Imagine.) Well this has come up again twice this week.

Firstly because Harry Styles announced Australia dates for next year. A few of my favourite people in the world live in Australia and one of them I met through Harry Styles fandom. So I wondered if I could possibly go. I googled flights. They were much less than I thought. I posted in my group chat that I was thinking about it and then...

...it became a plan.

And I feel a bit weird even writing about it here because I’ve written so much about being short of money and not earning enough, but I have money from the house and while I am worried about that, I’m mostly worried about frittering it away. That’s not the same as using it for an amazing thing. I mentioned this to a friend and she reminded me that I’ve also written about trying to let myself have nice things, which is true. And Australia would be a more than nice thing - I grin every time I think about it.

But also! This newsletter is late because I went to London for the weekend for my first gig since September 2019. No, not Harry Styles (but we did watch a livestream of his amazing Coachella set), Louis Tomlinson (also ex of One Direction).

I went with a friend and we had the best time. We drank wine and danced and sang (at the show) and then spent the rest of the weekend walking around Hampstead and eating delicious food (and yes there was more wine). And I didn’t even mind paying NINE QUID for a plastic cup of red at Wembley Arena because I was having a brilliant time. (And without all the wine, there wouldn’t have been all the dancing.)

I don’t want to hoard this house money. I don’t want to fret as I watch the number go down. I want to use at least some of it for wine and dancing and singing and friends. And Harry Styles. Obviously.

Paid subscriptions enable me to keep writing these newsletters. If you’re not a paid subscriber already, I’d love it if you’d consider upgrading. (And if you are, thank you, I love you.)

If you would like a paid sub, but can’t swing it right now, email me and I’ll sort it.

Kat H, Seattle, Washington, 51

Why do you think women are often reluctant to talk about money?

I think the common theory is that most women grew up with the messaging that talking about money wasn’t “ladylike”, but I actually think that women don’t talk about money or finances a lot because generally we’re more sensitive, probably too sensitive, about hurting people’s feelings. And talking about money inevitably seems to get feelings hurt.

Money is such a touchy subject and can be fraught with a ton of emotional meaning, which makes it a loaded topic. I can be completely open and honest with my close friends about the most taboo topics, but honest about money? I clam up because it’s uncomfortable.

What is your relationship with money currently?

I would describe my current relationship with my finances as – obsessively worried. I’m constantly anxious about not having enough funds on hand that I could use at a moment’s notice or enough savings for the future, even though I’m doing relatively okay.

I have a financial planner that I meet with quarterly and I’ve been saving for retirement for a healthy amount of time, but I also know that I’ve been solely responsible for my finances for most of my life, and I probably won’t ever have any kids or a spouse that’ll be around to take care of me when I’m old(er) and grey(er).

What’s your earliest money memory?

From a very young age I was aware that money was a stressor in my household. My parents seemed to always be talking and fretting about the state of their finances. I was an only child and neither of my parents ever really censored with they discussed around me.

When I was 5 or 6 my grandmother “gave” me my own personal checking account for my birthday. I remember going with her into the large old bank and walking up to the teller and on my tip toes handing her the crisp 100 dollar bill my grandmother had given me that morning. This was before ATM cards (I am OLD), but I remember leaving with this small notebook for the account, and my grandma whispering that she was going to teach me to keep track of everything myself.

Through the years she’d continue to deposit money into my account, and she encouraged me to not spend it. Looking back, I think it was her and my grandfather’s way of making sure I was okay because my parents were so horrible with money.

I knew we weren’t poor; we had nice things and went on nice vacations. What I didn’t know was that we were living on credit, my mom was regularly juggling bills and deferring payments on things, and my dad was spending any and all money on his drug habit.

As clueless as I was about the dirty details, I also instinctively knew that there was a limit to what I could have or ask to do or buy. I knew that if I wanted to go on that ski trip, or buy that Benetton sweater, I’d have to figure out a way to pay for it myself.

What’s the biggest money mistake you’ve made?

Letting myself get into a huge amount of credit card debt in my late 20s/early 30s. It was something that took over a decade for me to even begin to fix my, and my credit score was in the toilet for years. It took a long time for me to get this score up and to consistently have savings.

What’s the best thing you’ve ever spent money on?

I always have to say travel. And maybe specifically, travelling to concerts. I feel like I should probably say my first house or something that gave me equity, but the best thing truly has been those wonderful memories made on incredible trips.

Do you have a pension? If not, do you have a plan?

I think what the British call a pension is what Americans call a retirement fund?* But maybe it’s closer to what the federal government here gives us in social security benefits?

Anyway, I do have a few retirement funds. I have a tiny, miniscule IRA that was what my 401K balance from my first major job transferred into when I quit. Then when I started at my current company which is a non-profit, instead of a 401K non-profits have 403Bs. I think the only difference is the taxes that are paid? (See? I’m clueless about this and I’d rather not learn, which is probably not a good thing?)

Additionally, I got in just under the wire to my company’s pension plan which they stopped enrolment for about a month after I started working there. Most employers don’t do pension plans anymore; which is when a job guarantees their workers that there will be a specific fund that will have money in it for each year that they work there. The difference between this type of pension and a 401K/403B is that the employer is the sole funder.

And because I’m so paranoid that I won’t be able to take care of myself when I’m old older, I also have a small mutual fund and a stock portfolio that is managed by a financial adviser.

What would you do with £10,000?

Well because of the exchange rate, I think that would actually translate into like $12,000 for me? My go-to answer is always to pay off any debt I may have in the moment.

But honestly I think I’d invest it for a bit and then eventually put a down payment on a vacation home or seaside condo somewhere. I long to live right on/by the sea/ocean. Any body of water will do!

If you were me, what would you want to ask women about money?

I want to know more about what single women, especially single women of color are doing about saving and investing money for their futures.

I know a lot compared to most of my single female friends, but I know there’s a ton more I can and should still learn.

RELATED POSTS:

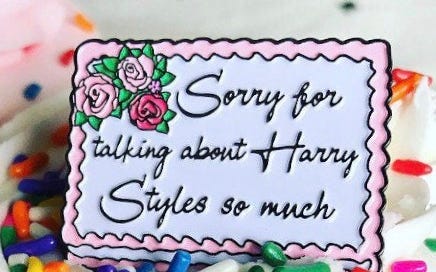

Sorry for talking about Harry Styles so much pin from Milly Pins.