Take some advice from a financial disaster...

+ living with disabling illness, and the value of therapy

I thought this week I’d tell you a few things that have helped me stop being quite so terrible with money. Or maybe just stopped me feeling quite so terrible about money. (Obviously - and I think even after just two weeks this is clear - I am not a person you should take any financial advice from.)

And yet!

The first thing is that knowing exactly how much money I have (or don’t have) has made a huge difference to me (scroll down if you want actual figures). Open any bills (if you still get them by post), make a spreadsheet of your debts, get to know your exact financial position. Even if it’s terrifying, I think it’s better to know.

Find out your credit score. Again, might be horrifying. But once you know what it is, you can work to improve.

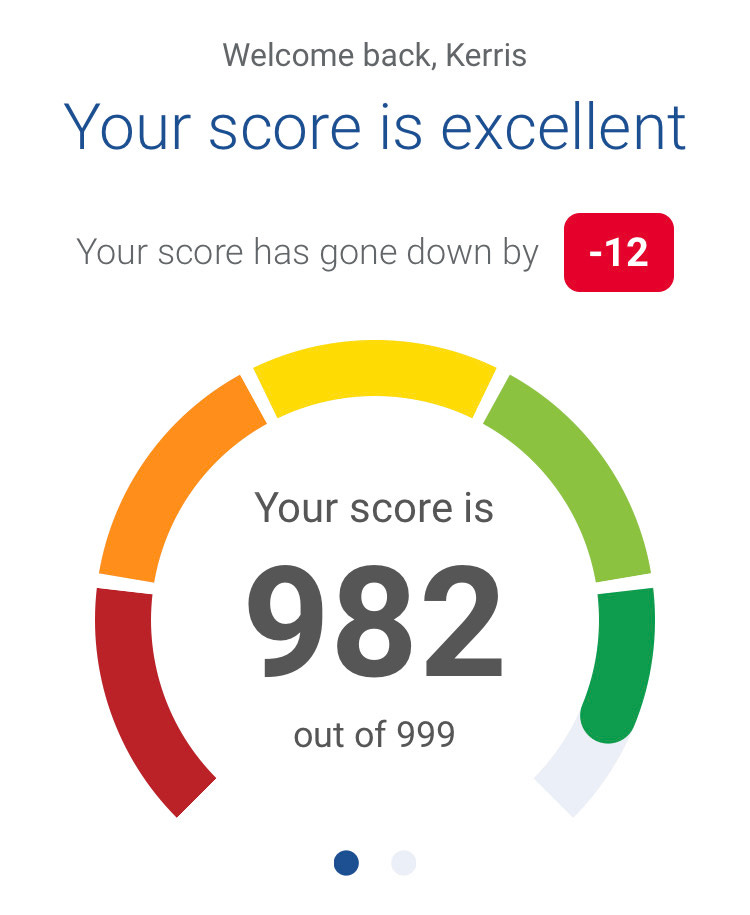

I signed up to ClearScore for free. It tells you your score along with the local and national average scores. At first I wanted to beat the local and once I did, I was determined to beat the national. (I also signed up to Experian, also free, not sure why I did, but they show the score differently and mine is currently “Excellent” which makes me happy. Sometimes, if I’m feeling stressed about my money situation, I just open the app and look at the graphic and feel calmer.

The main thing that made a difference to my credit score was not missing payments. I used to miss them a lot, either because I forgot or because I didn’t have the money.

Rather than missing payments, if I was struggling or couldn’t pay, I started calling the companies and explaining. They were always much kinder, more helpful and more flexible than I expected them to be.

I have read - and continue to read - so many money books (will no doubt write about that at some point), but I absolutely recommend The Art of Money by Bari Tessler, a really gentle and practical guide to healing your relationship with money. Something Bari suggests that’s so simple but was actually transformative for me, is to rename your money stuff, e.g. I used to have a box of money apps on my phone called Finances and I changed it to Happy Money and it honestly made me feel better instantly. Instead of ‘emergency fund’ or ‘rainy day’ (which might make you feel panicky) you could call it ‘security fund’ or ‘sunny day.’ Find something that doesn’t make you clench when you click on it.

This is not to say I’ve got it all sorted, far from it. God, so far. Right now I’m £254.39 overdrawn. I have no savings. I’ve currently got *checks ClearScore* £5,026 of short term debt. I’m making a (small) monthly payment towards (large) tax arrears. I haven’t started repaying my student loan, even though I graduated in 2001. My pension is currently worth £8,012.29 (and I’m 50). My income last month was £75.10 (I get Universal Credit and my ex is currently paying a percentage of the bills since we still co-own the house.)

Wow, that last paragraph is… not good. But since I started keeping track of my money, I feel more in control and I don’t lie awake worrying so much.

Paid subscriptions enable me to keep writing these newsletters. If you’re not a paid subscriber already, I’d love it if you’d consider upgrading. (And if you are, thank you, I love you.)

If you would like a paid sub, but can’t afford it right now, email me and I’ll sort it.

If you’d prefer not to subscribe right now, but would still like to support me/this newsletter, you can buy me a coffee.

(More than) enough about me. This week I’m talking to Diane S, a writer in the UK.

I remember asking for something in a shop when I was young and my mum saying she didn't have enough money, so I responded: "Just write a cheque!" That should be how it works.

Why do you think women are often reluctant to talk about money?

Well, we're socialised not to, which keeps us in the dark and earning less than men. It's also so strongly tied with ideas about self-worth that it's embarrassing if you're not making much or in debt. It feels like it says something about your value as a person, and that's not just in our heads, some people will judge us for it.

What is your relationship with money currently?

If I zoom in, I'd say tentatively hopeful. In the last couple of years, I've paid down my credit card debt from almost £8000 to just under £2500. I have a couple of regular gigs and feel fairly sure there are more opportunities out there, and two of my student loans will be written off in 2023. I've even saved up next year's tax!

If I think about the big picture, I have no pension (not even any entitlement to a state pension), I live in a council flat with my mum because I can't afford to live independently, I haven't taken a holiday in over a decade, have 8p in savings and live with a disabling illness which means I'll never have the earning potential of an able-bodied person. But it could be -- and has been --- worse.

What’s your earliest money memory?

I remember when I was about four or five and my mum would sit on the carpet, sorting coins to take to the bank, which looked like such fun. She'd put the copper coins in piles of ten 1ps or five 2ps but when I tried to help, I'd always put coins in the wrong piles because I didn't understand the system. Which seems like a great omen.

Did your mum talk to you about money growing up?

If she did, I don't remember it. Partly that was good -- she struggled financially much more than I realised at the time, especially after she became a single mum, but I was oblivious to it. I don't think she ever gave me any practical tips, and I never thought to ask.

(My dad did when I went to university, but it was all stuff I didn't want to hear, like invest your student loan or don't buy fizzy drinks, just have water.) I do remember once asking for something in a shop when I was young, I can't remember what, and my mum saying she didn't have enough money, so I responded: "Just write a cheque!" That should be how it works.

What’s the biggest money mistake you’ve made?

I've done a lot of ridiculous things, from frittering away literally thousands of pounds on useless supplements and health treatments to spending my first student loan on a trip to Florida (my dad told me to invest it). I also wish I'd understood how quickly credit card interest can accrue before I saw it first-hand.

But the biggest mistake I made was becoming ill. That wasn't my choice, of course, but I think it illustrates the fact that so many financial problems we face, particularly as women, are systemic. (More women than men live with disabling illnesses, especially as we age, and we're paid less to start with.)

Becoming ill meant that I had to tangle with the disability benefits system for over a decade, dropped out of university but was still liable for those loans and grants, and haven't been able to rent my own place, run a car, or do most of the things I'd wanted from life. It also meant I lived off my credit cards for months at a time, when I was too ill to work but the DWP decided I was fine.

What’s the best thing you’ve ever spent money on?

Therapy, which is both a huge privilege and a financial burden but has genuinely changed my life. The therapist I have now helped me so much with stress that I became able to seek out and hold onto regular work. Having an income over the tax threshold allowed me to get 0% credit card transfers (thanks to my mum walking me through the process) so I could finally start to pay down my debt.

I also started to think about achievable goals, which led me to start an M.A earlier this year. Both that (which will cost me £11,000 if I earn enough to pay it back) and the therapy sometimes seem like ridiculous indulgences -- I worry I should use what energy I do have hustling to pay off debt and save up for the future instead -- but I also need a reason to get out of bed in the morning. I feel lucky that for now, I can make this work.

What would you do with £10,000?

If I had half-decent health and we weren't in Covid times, I'd be on a flight ASAP (America? Australia? Japan? South Korea? Yes). Seeing as we are in Covid times, the sensible thing to do would be to replace all the on-their-last-legs appliances in the flat and pay off the rest of my credit card debt. But what I'd really like to buy is time -- to cover costs for a few months so I could concentrate on writing.

If you were me, what would you want to ask women about money?

Everything! I'm very nosy. How much do you earn and how do you feel about it? Do you save money and how much? How are you planning for the future (if you're able to)? What external circumstances have impacted your current financial situation, for better and worse? When were you poorest? What help have you had (financial/practical) to reach goals like buying a house? What government policies/social changes would make your financial life easier? But I realise it's much easier for me to suggest these topics than for you to ask them!

These are questions I too would love to ask, but haven’t been brave enough yet!

Related posts from the archive:

If I could turn back time...

I remember when I was a teenager seeing my mum on her hands and knees in our hall, scrubbing the carpet. I said there was no way I’d do that when I grew up and had my own home, I’d rather buy a new carpet. She said “You’ll have to marry a rich man then.” I told her I wouldn’t need to marry a rich man. That I’d be rich. I felt it. I meant it. (I’m still …

"Covid/lockdown meant we had time and impetus to have a look at what we were spending and earning, what we wanted to do with our money and with the rest of our lives."

Authors & Money is a short series of interviews with authors, inspired by author Lindsay Galvin. I’ll be posting as usual on Mondays with an additional Thursday interview post until I run out of authors. An interview with… Carrie Dunn Carrie Dunn is a writer, specialising in sport, and women's football in particular. Her new book 'Unsuitable For Females' (…

Good to read this, thanks Diane (and Keris). I'd forgotten about my student loans! I think I'm in denial that I owe... wait while I tot it up...*ahem* well over £30,000 through SFE, but I always said that if I ever reached the dizzy heights of earning over --is it--£25,000 p.a.? then I won't mind paying back a pound a day until it gets written off. I'm pretty sure I'll reach 80 before I ever earn anything near that.